Transportation Infrastructure Financing and Innovation Act (TIFIA)

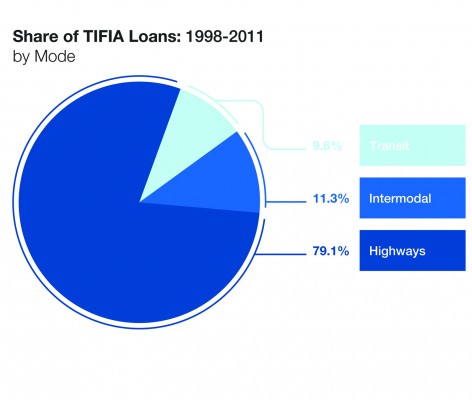

The TIFIA program provides loans, loan guarantees, and standby lines of credit to highway, bridge, transit, and intermodal freight projects that have a dedicated source of revenue pledged toward repayment.

TIFIA loans are an attractive financing option because 1) the government offers a lower interest rate than is typically available to project sponsors through traditional bond markets and 2) the repayment terms are flexible, including the ability to defer repayment so a project can get underway and/or begin generating user fees or other revenues before repayment begins.

With the passage of MAP-21, the TIFIA program changed in three major ways: first, the amount of money available for loans multiplied eight-fold; second, TIFIA projects will no longer be chosen through a competitive process, instead awarded on a first come, first served basis; and third, technical changes will make TIFIA financing more accessible for transit projects supported by sales, property, or income taxes.

Funding

SAFETEA-LU: $122 million per year

MAP-21: $750 million in FY13, $1 billion in FY14

The TIFIA program authorization is a form of credit subsidy. The actual direct loan comes from the Treasury Department. Every TIFIA program dollar can leverage approximately ten dollars in direct loans. Over the next two years of MAP-21, the TIFIA program will be able to support more than $17 billion in direct loans to eligible surface transportation projects.

Eligible projects

TIFIA may finance construction of highways, bridges, transit, intermodal freight facilities and projects related to intercity rail and bus service. Moreover, multiple projects may be bundled together under one loan application as long as they are to be repaid by a common revenue source.

In order to take advantage of TIFIA financing, project sponsors must have a reliable source of local revenue to pledge as repayment. For highway and bridge projects, this typically involves charging roadway users a toll. Transit projects are often supported by sales and property taxes.

How the program works

All TIFIA loans will now be provided on a first-come, first- served basis. If a project is eligible and meets the cost threshold below, a project sponsor will receive a TIFIA loan that can cover up to 49 percent of total project costs.1 Moreover, USDOT may commit all $1.75 billion in TIFIA financing — including the entire second year of funding for FY14 — during the first year.

All TIFIA loans will now be provided on a first-come, first- served basis. If a project is eligible and meets the cost threshold below, a project sponsor will receive a TIFIA loan that can cover up to 49 percent of total project costs.1 Moreover, USDOT may commit all $1.75 billion in TIFIA financing — including the entire second year of funding for FY14 — during the first year.

In order to be eligible to receive a loan, a project must have a total cost of more than $50 million or exceed 33 percent of what a state receives in federal highway dollars for a year. Project sponsors are permitted to bundle related projects together in order to meet that total cost threshold, provided they are all secured by a common repayment source.

In rural areas, project costs must exceed $25 million. Also, rural projects are eligible for a loan with an interest rate at half of the rate offered to projects in urban areas. (As of this writing, the current TIFIA rate is 2.97 percent. For rural projects, this would drop to 1.41 percent.) Intelligent transportation system (ITS) projects must exceed $15 million.

Prior to MAP-21, many transit projects were unable to compete for TIFIA financing due to technical provisions. MAP-21 includes important provisions that will allow transit projects supported by broad-based tax revenues such as sales and property taxes to more easily qualify for TIFIA loans.

The Crenshaw line in Los Angeles received a $545 million TIFIA loan for construction